Airbnb vs. Traditional Rentals in BC: Which is Right for You?

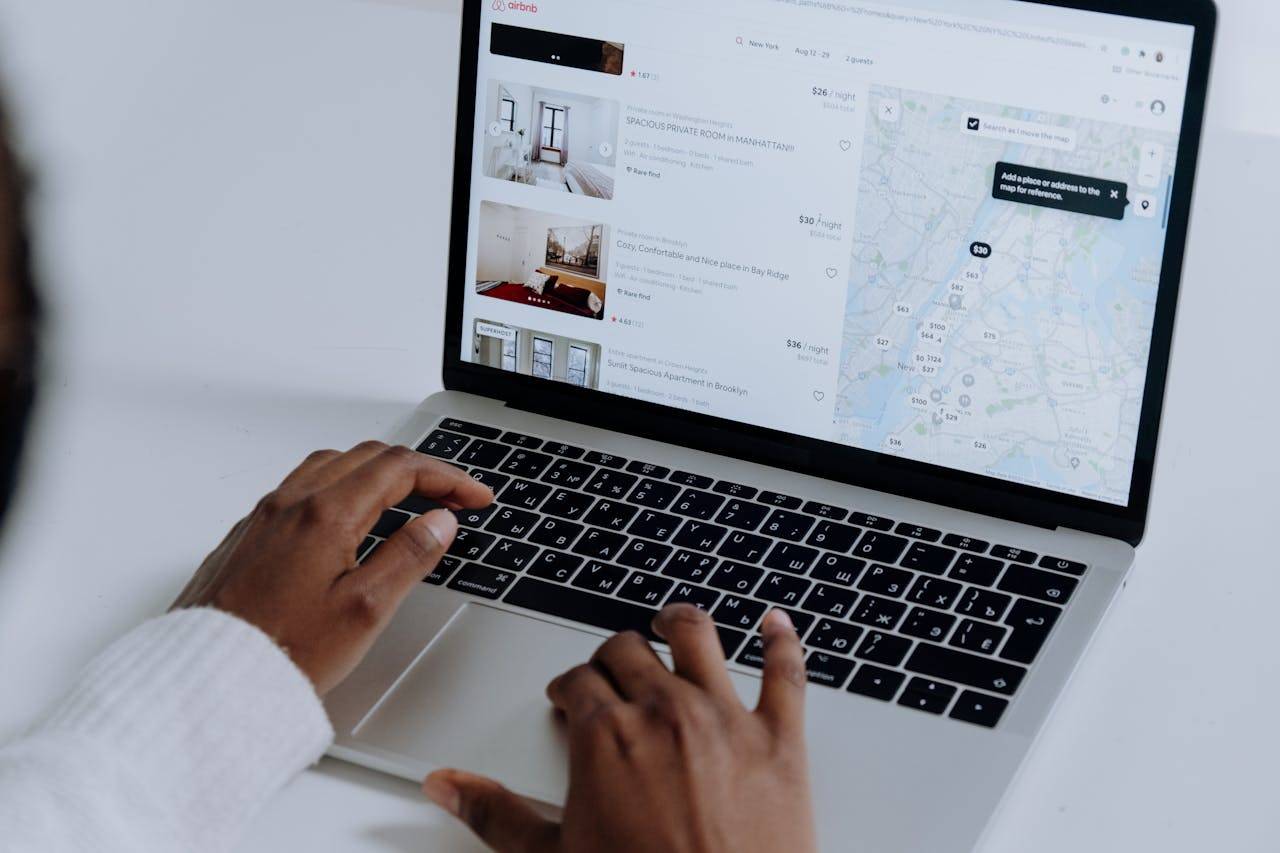

Are you considering investing in rental property in British Columbia? If so, you've probably weighed the merits of traditional long-term rentals against the growing popularity of Airbnb. Both options offer unique advantages and drawbacks, and understanding the key differences can help you make an informed decision.

In this blog post, we'll delve into the pros and cons of Airbnb vs. traditional rentals in BC, exploring factors such as income potential, management requirements, and guest experiences. Let's dive in!

Airbnb offers higher potential income but requires more management, while traditional rentals provide a more stable income stream with less management.

Airbnb Rentals: All You Need to Know

Airbnb has revolutionized the travel industry, offering travellers a unique and often more affordable accommodation option than traditional hotels. For property owners, Airbnb presents an opportunity to earn additional income by renting out their homes or spare rooms. However, before diving into the world of Airbnb, it's important to understand both the potential benefits and drawbacks.

Pros of Airbnb Rentals

- Higher Potential Income per Night: One of the primary advantages of Airbnb is its flexibility in pricing. Unlike traditional long-term rentals, which often have fixed monthly rates, Airbnb hosts can adjust their prices based on factors such as demand, seasonality, and special events. This allows for higher potential earnings, especially during peak periods or for in-demand properties.

- Flexibility in Pricing and Availability: Airbnb allows you to set your own prices and availability, giving you greater control over your rental income. You can adjust your rates based on demand, seasonal fluctuations, and special events.

- Opportunity to Meet People from Around the World: Hosting Airbnb guests can be a rewarding experience, allowing you to connect with people from diverse cultures and backgrounds.

- Potential for Additional Revenue Streams: Beyond the base rental fee, you can generate additional income through cleaning fees, guest amenities (e.g., breakfast, parking), and extra services (e.g., airport transfers).

Cons of Airbnb Rentals

- More Time and Effort Required for Management: Managing an Airbnb listing can be time-consuming, involving tasks such as cleaning, communication with guests, check-ins, and property maintenance.

- Potential for Wear and Tear on the Property: Frequent turnover of guests can lead to increased wear and tear on your property. Regular maintenance and cleaning are crucial for preserving the value and appeal of your Airbnb property. Neglecting these tasks can lead to wear and tear, damage, and decreased guest satisfaction, ultimately impacting your rental income.

- Regulatory Challenges in Some Areas: Airbnb has faced regulatory scrutiny in many cities and countries. It's important to be aware of local regulations and obtain any necessary permits or licenses.

- Seasonal Fluctuations in Demand: Demand for Airbnb rentals can vary significantly throughout the year, especially in tourist-driven locations. This can impact your income and occupancy rates.

Traditional Rentals: A Reliable Investment Strategy

Traditional rentals, where properties are leased to tenants on a long-term basis, have been a popular investment strategy for centuries. While they may not offer the same short-term income potential as Airbnb, traditional rentals provide a more stable and predictable income stream.

Pros of Traditional Rentals

- More Stable and Predictable Income Stream: Unlike Airbnb, which can experience fluctuations in demand, traditional rentals often provide a more consistent income flow. Long-term leases provide a consistent and reliable source of rental income.

- Less Time and Effort Required for Management: Compared to Airbnb, traditional rentals generally require less time and effort to manage. Once a tenant is in place, property management tasks are typically limited to rent collection, maintenance, and addressing tenant concerns.

- Potential for Long-Term Tenant Relationships: Building strong relationships with long-term tenants can be beneficial. Loyal tenants are less likely to move frequently, reducing vacancy periods and increasing the stability of your rental income.

- Tax Benefits: Traditional rentals offer several tax benefits, including depreciation deductions and rental income deductions. By taking advantage of depreciation deductions and rental income deductions, landlords can significantly reduce their overall tax liability.

Cons of Traditional Rentals

- Lower Potential Income per Month: While traditional rentals provide a more stable income, the monthly rental income may be lower than what you could potentially earn through short-term rentals like Airbnb.

- Difficulty in Finding and Retaining Good Tenants: Finding reliable and responsible tenants can be challenging. Screening tenants carefully and maintaining a good property condition can help minimize tenant turnover.

- Potential for Vacancy Periods: Even with long-term leases, vacancy periods can occur due to tenant turnover or other reasons. During these periods, you won't receive rental income.

- Limited Flexibility in Pricing and Availability: Unlike Airbnb, traditional rentals typically have fixed lease terms and rental rates. This limits your flexibility in adjusting pricing and availability based on market conditions.

Key Factors to Consider

When deciding whether to rent your property out through Airbnb or traditional long-term rentals, several factors must be taken into account. These include property location, property type, investment goals, risk tolerance, and the regulatory environment.

Property Location

- Airbnb Popularity: Analyze the popularity of Airbnb in your area. If Airbnb is thriving in your neighbourhood, it may be a viable option for short-term rentals.

- Long-Term Rental Demand: Assess the demand for long-term rentals in your area. Factors such as the job market, local amenities, and overall desirability of the location will influence tenant demand.

Property Type

- Suitability for Short-Term Rentals: Consider whether your property is suitable for short-term rentals. Smaller properties with modern amenities and convenient locations often appeal to Airbnb guests.

- Suitability for Long-Term Rentals: Larger properties with more permanent features, such as kitchens and laundry facilities, are typically better suited for long-term tenants.

Investment Goals

- Short-Term Income: If your primary goal is to generate short-term income, Airbnb may be a better option. It offers the potential for higher nightly rates and flexible pricing.

- Long-Term Capital Appreciation: If you're focused on long-term capital appreciation, traditional rentals can be a solid investment. Owning rental property can increase your net worth over time.

Risk Tolerance

- Airbnb Risks: Airbnb involves more risk due to factors such as potential property damage, guest cancellations, and regulatory changes.

- Traditional Rental Risks: Traditional rentals carry risks like tenant turnover, vacancy periods, and maintenance costs.

Regulatory Environment

- Airbnb Regulations: Before starting an Airbnb rental business, it's essential to research and comply with local regulations. Many areas have specific requirements for short-term rentals, including obtaining permits, and licenses, or adhering to zoning restrictions. Failure to comply with these regulations can result in fines or penalties.

- Traditional Rental Regulations: Understand the regulations governing traditional rentals in your area, including tenant rights and landlord responsibilities.

By carefully considering these factors, you can make an informed decision about whether Airbnb or traditional rentals are the best choice for your property and investment goals.

Final Thoughts

The choice between Airbnb and traditional rentals in BC ultimately depends on your individual circumstances and preferences. If you're seeking higher potential income per night, more flexibility in pricing and availability, and the opportunity to meet people from around the world, Airbnb may be the right choice for you. However, be prepared for the additional management responsibilities, potential wear and tear on your property, and regulatory challenges.

If you prioritize a more stable and predictable income stream, less management hassle, and the potential for long-term tenant relationships, traditional rentals may be a better fit. While the income per month may be lower, you'll enjoy greater stability and tax benefits.

It's important to carefully consider factors such as property location, property type, investment goals, risk tolerance, and the regulatory environment in BC. By weighing these elements, you can make an informed decision that aligns with your financial objectives and lifestyle.

Ultimately, the best way to determine which rental strategy is right for you is to conduct thorough research, consult with local experts, and consider your specific circumstances. If you have any doubts or need guidance on purchasing Homes for sale Pitt Meadows, the Grayly Team is ready to answer all your questions, reach out to us!

FAQs

1. What is the difference between Airbnb and traditional rentals?

Airbnb is a platform that connects property owners with travellers seeking short-term accommodations. It allows property owners to rent out their homes or rooms for stays ranging from a few days to a few months. Traditional rentals, on the other hand, involve leasing a property to tenants for longer periods, often on a yearly basis.

2. Which option offers higher potential income?

Airbnb often offers the potential for higher nightly rates, particularly in sought-after tourist locations. This can lead to greater earnings, especially during peak seasons. However, traditional rentals typically provide a more consistent and reliable income flow over the long term, as they involve longer-term leases.

3. Which option requires more management?

Airbnb typically requires more management, as it involves tasks such as cleaning, communication with guests, and handling check-ins. Traditional rentals involve less management, especially with long-term tenants.

4. What are the tax implications of each option?

Both Airbnb and traditional rentals have tax implications. Airbnb income is generally considered taxable income, while traditional rental income may be subject to certain deductions and tax benefits.

5. Which option is better suited for first-time investors?

Traditional rentals may be a better starting point for first-time investors due to their more predictable income stream and lower management requirements. However, if you have a higher risk tolerance and are willing to invest more time and effort, Airbnb could be a viable option.